Although there are roughly 28,000 farriers scattered across the United States by American Farriers Journal estimates, little is researched about their business habits. Even with AFJ’s biennial Farrier Business Practices Surveys, information is limited concerning how the average farrier impacts the broader economy. American Farriers Journal has compiled the most reliable information concerning the farrier industry’s economic impact to provide a snapshot of the industry you are entering.

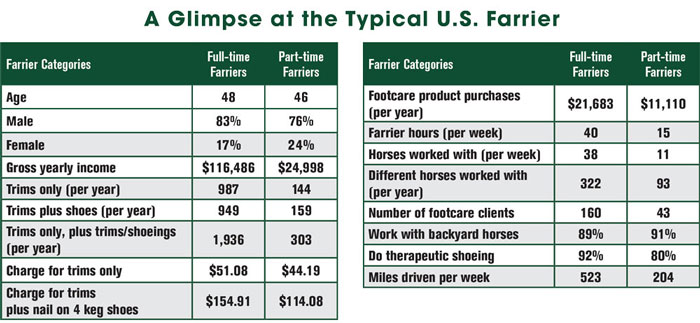

The growth of the farrier industry is exceptional, with the average farrier gross income having increased significantly over the past 5 years, from $98,000 in 2017 to $116,500 in 2020, as data from the 2017 and 2020 Farrier Business Practices Surveys reveal. These figures come from the typical farrier shoeing backyard, trail and recreational mounts; although farriers can earn more from shoeing more specialized breeds and disciplines, such as dressage horses or racing Thoroughbreds. Farrier earnings account for more than $2.250 billion in total gross income. Gross income can vary depending on a number of factors, not least of which would be the region you’ve set up your business in.

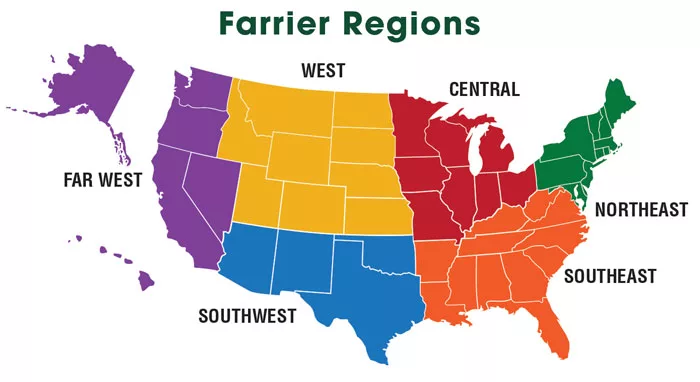

For instance, the far west region of the U.S., which includes California, the second most populous state for horses, has generally higher costs for shoeing horses. The southwest region, which includes Texas, the state with the most horses, has slightly lower costs for trimmings and various types of shoeing, where the average cost clocks in a few dollars lower than the Pacific Coast. These regional differences can affect a farrier’s bottomline and should be considered when setting up a business.

Though the gross income for the typical farrier may seem high, it is important to remember that the majority of farriers run their own businesses, meaning they have various business expenses to pay for out of pocket, which cut into their take-home pay. The average farrier spends $21,683 a year on footcare products, which calculates to an estimated $517 million in expenditures per year. Needless to say, farriers contribute a significant amount of spending into the broader equine economy.

Two Essential Costs to Prepare for the Future

Most farriers also have to cover their own insurance costs too, because nearly 90% of farriers work independently, with no staff or employer. That number has not changed since 1999, according to an Occupational Outlook Quarterly article.

More than 85% of farriers carry health insurance and 57% carry life insurance policies. While nearly 49% of farriers hold some sort of liability insurance, with disability insurance ranking at a significantly lower rate, coming in at 36%. Along with work vehicle or equipment insurance, these expenses can continue to rack up money paid out of pocket for farriers. While different forms of insurance may seem like an unnecessary expenditure, having insurance offers benefits for farriers. Should an injury occur while a farrier is under the horse and the farrier is unable to work for a period of time, they would still be able to gather some income from their saved disability insurance benefits, for example.

In addition to insurance payments, a large portion of farriers also fund their own retirement plans. More than 75% have either 401(k)s, IRAs, pension plans or a combination of plans. While nearly a quarter of farriers responded that they do not currently have a retirement plan, more than half of those that have started planning for their retirement say they began making payments into those accounts in their 20s and 30s.

The varied types of insurance are some of the expenses you will incur throughout your career. In all, though the average farrier may make a higher gross income than many other professions, the expenses that farriers accumulate will significantly affect their net financial gains. Be mindful that what you charge per horse provides the lifestyle you want.