American Farriers Journal

American Farriers Journal is the “hands-on” magazine for professional farriers, equine veterinarians and horse care product and service buyers.

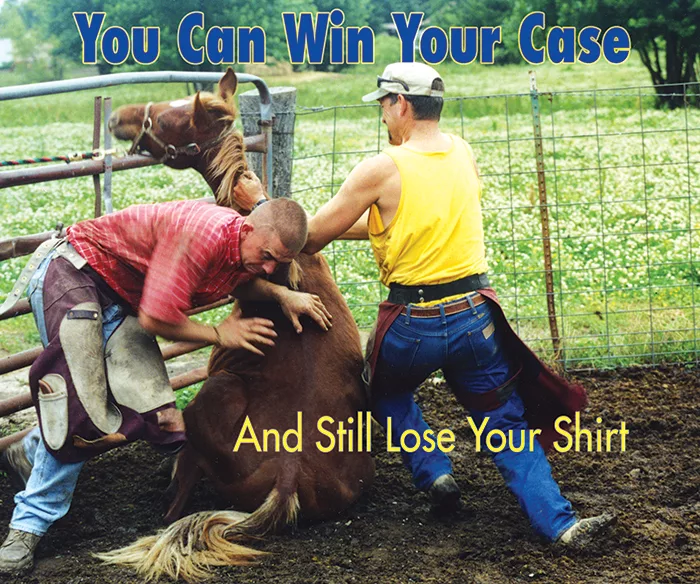

UNPREDICTABLE PROFESSION. Not every horseshoeing goes exactly as planned. That’s one reason farriers need to invest in liability coverage that will help protect them from lawsuits.

Things are going good; your business is growing, you work on horses who know the drill, and your clients pay on time. You’re even thinking about outfitting a new truck. And then a high-end jumper, who’s normally quiet when standing in cross-ties, spooks just as you’re driving in the last nail. He gets cut, flips out and throws you against the wall, breaking your arm in two places — just as he bolts into your tool box, then falls on a rasp, puncturing his leg.

After all is said and done, the feeling of relief you have that you’re still alive fades into the grim reality of being out of work for 12 of the busiest weeks in the season — made grimmer by the fact that the horse owner is threatening to sue you for negligence . . . and you have no insurance . . .

Because farriery can be a risky business, it’s worth understanding the ins and outs of legally protecting yourself, since as farriers know too well, with horses, anything can happen. William Miller, Jr., horse owner and attorney at law with Langrock, Sperry & Wool, LLP, recently talked about the importance of taking steps BEFORE an incident at a meeting of the Vermont Farriers Association.

“Terms like negligence and liability are often tossed around without a…